inherited annuity taxation irs

Qualified employee annuity plan section 403a plan c. While having a guaranteed lifetime income sounds appealing it might be in your best interest to use this.

Ad Learn More about How Annuities Work from Fidelity.

. Ad Get this must-read guide if you are considering investing in annuities. An annuity is a financial product that can be passed down from one generation to another. Deferred compensation plan of a state or local government.

Federal income tax must be paid on the full amount of. Generally a qualified annuity is funded with pre-tax dollars while a non-qualified annuity is funded with after-tax dollars. You have an annuity purchased for 40000 with after-tax money.

Taxes are also affected by when and how you withdraw your annuity funds. Unlike other investments the named beneficiary of a nonqualified annuity does not get a step-up in tax basis to the date of death. If a trust charity or estate is the beneficiary of a.

In turn taxation of annuity distributions. The basis of property inherited from a decedent is. If a beneficiary opts to receive the money all at once they must pay taxes immediately.

Tax-sheltered annuity plan section 403b plan d. However that doesnt mean the beneficiary will have. Can I sell an inherited annuity.

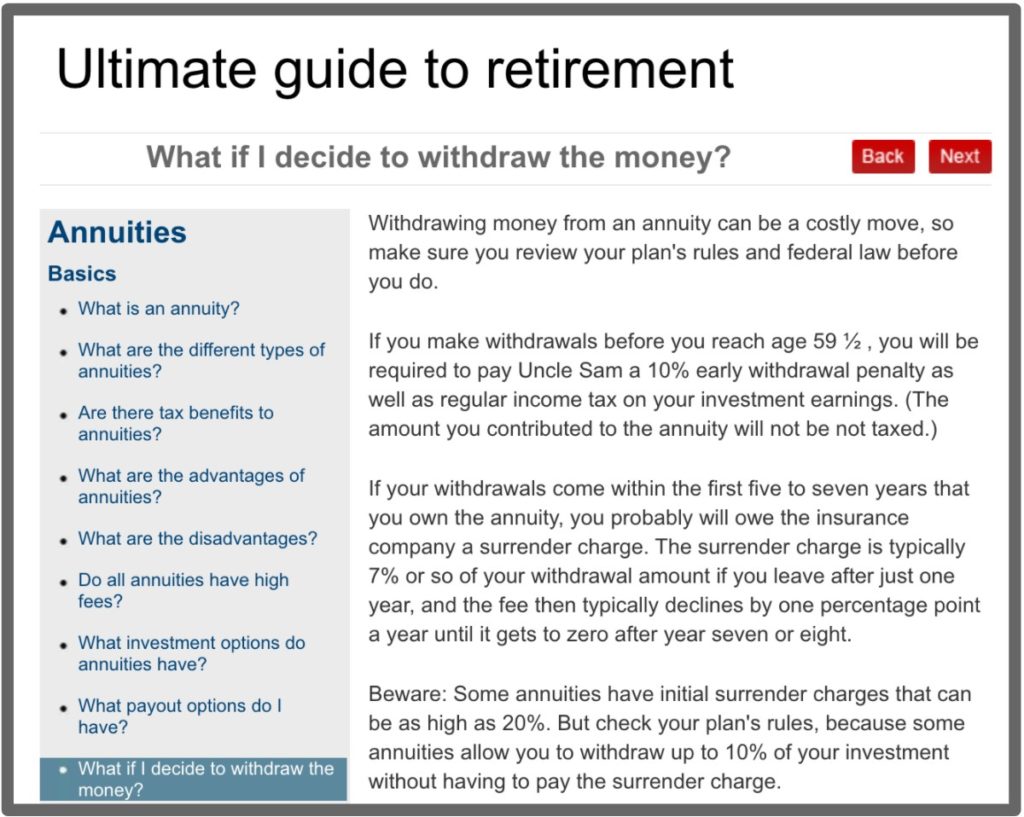

You should receive a Form 1099-R. There may be a 10 penalty on the taxable portion of a withdrawal from an annuity if you withdraw it. Annual payments of 4000 10 of your original investment is non-taxable.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. There may be a 10 penalty on the taxable portion of a withdrawal from an annuity if you withdraw it. These payments are not tax-free however.

You live longer than 10 years. Free Case Review Begin Online. You May Qualify for an IRS Forgiveness Program.

If you inherit an annuity you may have to pay taxes on your money. For example if you receive an IRA as a beneficiary it is income to you as it would have been income to the decedent. According to the IRS.

Ad Based On Circumstances You May Already Qualify For Tax Relief. The proceeds of inheritance are taxable. Ad Learn More about How Annuities Work from Fidelity.

Annuities are taxed as ordinary income when inherited. Annuities are often complex retirement investment products. Taxes are also affected by when and how you withdraw your annuity funds.

IRD is the income element of inherited property. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. To determine if the sale of inherited property is taxable you must first determine your basis in the property.

Act Now Submit Our Form. The internal revenue service IRS taxes annuity income to the extent of gains distributed from the contract and gains are distributed first. So consult your tax advisor.

Learn some startling facts. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Tax obligations may possibly be deferred by rolling the lump-sum distribution over into an individual retirement account.

Ad Owe the IRS. If you opt to receive a lump-sum payment of all. See If You Qualify For IRS Fresh Start Program.

End Your Tax Nightmare Now. Make a Thoughtful Decision For Your Retirement. If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed.

Annuity Beneficiaries Inheriting An Annuity After Death

Opinion The Tax Loophole That Helps America S Richest Families Stay That Way The New York Times

Annuity Beneficiaries Inheriting An Annuity After Death

Pin By Tony Mungiguerra On Leadership Minor Change Management Leadership Stock Images Free

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Taxation How Various Annuities Are Taxed

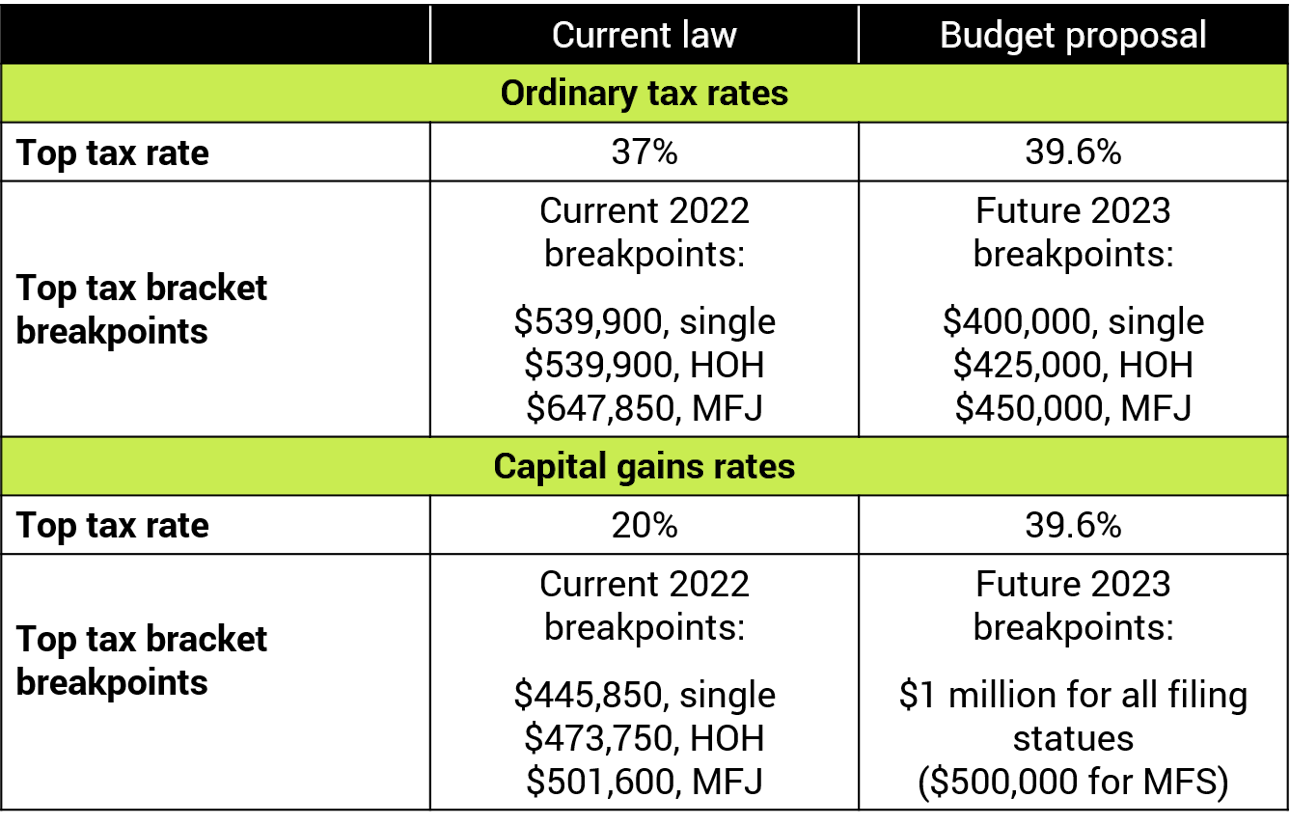

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Annuity Taxation How Various Annuities Are Taxed

Inherited Annuity Tax Guide For Beneficiaries

Understanding Annuities And Taxes Mistakes People Make Due

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Tuition Payment Federal Income Tax Tax

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Inherited Annuity Tax Guide For Beneficiaries

How To Avoid Paying Taxes On An Inherited Annuity

Traditional Vs Roth Iras Key Differences Roth Ira Roth Ira

U S Estate Tax For Canadians Manulife Investment Management

Annuity Tax Consequences Taxes And Selling Annuity Settlements